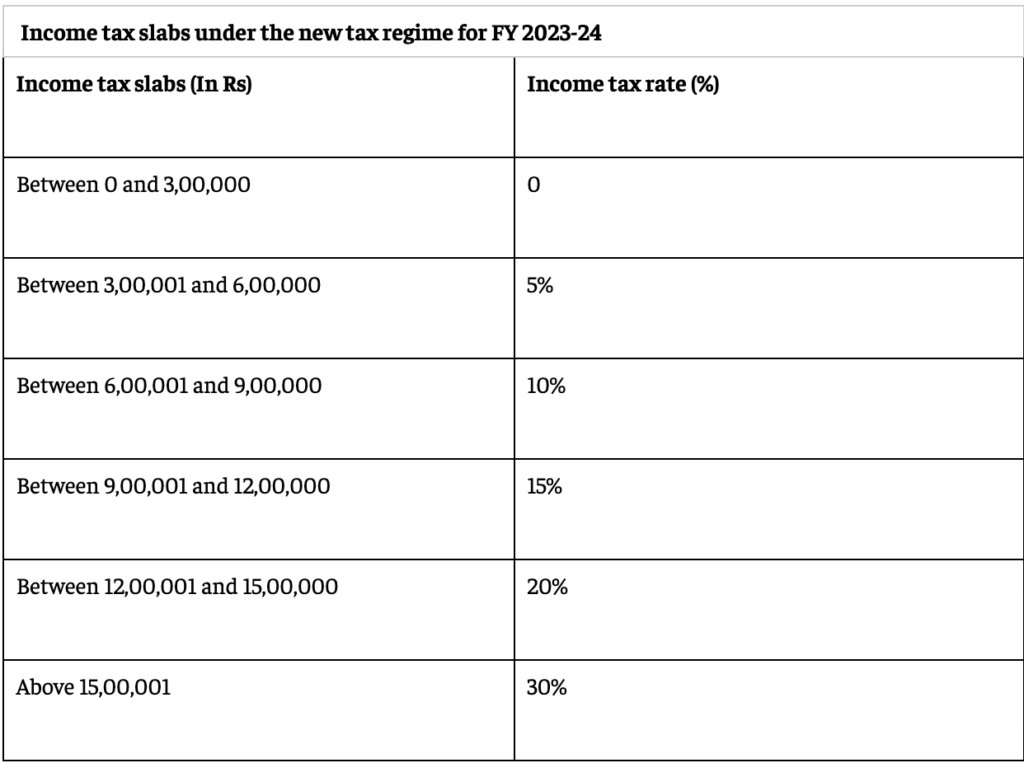

The Income Tax Slabs for the new tax regime have been modified in the Budget 2023. The government has decided to increase the basic income exemption limit from Rs 2.5 lakh to Rs 3 lakh under the new tax regime. Additionally, the rebate eligibility ceiling has also been raised through Section 87A from Rs 5 lakh to Rs 7 lakh taxable income. This implies that individuals choosing the new tax regime in FY 2023-24 will not have to pay any taxes as long as their taxable income remains below Rs.7 lakh.

In simpler terms, this means that the new tax regime has made it easier for individuals to save more of their income by raising the basic income exemption limit and the rebate eligibility ceiling. Therefore, people who earn less than Rs 3 lakh per annum will not have to pay any taxes under this new tax regime. Moreover, individuals earning between Rs 3 lakh to Rs 7 lakh will be eligible for tax rebates, which will significantly reduce their tax liabilities.

Overall, the new tax regime aims to provide relief to taxpayers and encourage compliance. By increasing the exemption limit and rebate eligibility ceiling, the government has given a significant boost to taxpayers’ disposable income. This, in turn, will promote spending and investment in the economy, leading to overall economic growth.

The proposed new tax regime for FY 2023-24 has several differences compared to the existing new tax regime, which is applicable till FY 2022-23.

Firstly, the basic exemption limit has been increased from Rs 2.5 lakh to Rs 3 lakh, which means that individuals earning up to Rs 3 lakh annually will not have to pay any taxes.

Secondly, the number of income tax slabs has been reduced from 6 to 5, which will simplify tax calculations for taxpayers.

Thirdly, the tax rebate under Section 87A has been increased to a taxable income level of Rs 7 lakh from Rs 5 lakh. The amount of tax rebate has also doubled to Rs 25,000 from Rs 12,500, which means that individuals earning up to Rs 7 lakh annually will be eligible for a maximum tax rebate of Rs 25,000.

Fourthly, the highest surcharge rate has been reduced from 37% to 25% under the new tax regime, which will reduce the tax burden on high-income taxpayers.

Lastly, a standard deduction of Rs 50,000 has been introduced from FY 2023-24 for salaried individuals and pensioners, which will further reduce their taxable income.

In summary, the proposed new tax regime for FY 2023-24 aims to simplify the tax structure and provide relief to taxpayers. The changes such as increased basic exemption limit, reduced surcharge rates, and higher tax rebate eligibility levels will significantly reduce the tax liabilities of taxpayers. The introduction of a standard deduction will further increase the disposable income of salaried individuals and pensioners.

Leave a Reply